idaho sales tax rate by county

The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9.

So whilst the Sales Tax Rate in.

. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. As for zip codes there are around 13 of them. A full list of these can be found.

31 rows The state sales tax rate in Idaho is 6000. 278 rows 2022 List of Idaho Local Sales Tax Rates. These local sales taxes are sometimes also referred to as local option taxes because the.

The base state sales tax rate in Idaho is 6. The minimum combined 2022 sales tax rate for Boise County Idaho is. Local level non-property taxes are allowed within resort cities if.

The 2018 United States Supreme Court decision in South Dakota v. This is the total of state and county sales tax rates. Counties and cities can charge an.

Heres how Idaho Countys maximum sales tax rate of 7 compares to other counties around the United States. Our dataset includes all local sales tax jurisdictions in Idaho at state county city and district levels. What is the sales tax rate in Boise County.

Lowest sales tax 6 Highest sales tax 9 Idaho Sales Tax. The Idaho ID state sales tax rate is currently 6. 2022 Idaho Sales Tax By County Idaho has 12 cities counties and special districts that collect a local sales tax in addition to the Idaho state sales tax.

With local taxes the total sales tax rate is between 6000 and 8500. Some cities and local governments in Idaho County collect additional local sales taxes which can be as high as 1. Prescription Drugs are exempt from the Idaho sales tax.

Idaho County is located in Idaho and contains around 13 cities towns and other locations. Sales Tax Distribution by County for 92010 10-22-2010 County-City BaseExcess S2. Higher maximum sales tax than 82 of Idaho counties.

Some Idaho resort cities have a local sales tax in addition to the state sales tax. The Idaho sales tax of 6 applies countywide. A sample of the 317 Idaho state sales tax rates in our database is provided below.

BeerWine Tax Hub Business Basics Hub CigTobacco Tax Hub Compliance Audit Hub. Sales Tax Rate s c l sr. Managing your Idaho taxes with TAP.

Idaho Sales Tax Map Legend. A customer living in Sun Valley Idaho finds Steves eBay page and purchases a 350 pair of headphones. Lowest sales tax 6 Highest sales tax 9 This interactive sales tax map map of.

Find your Idaho combined state and local tax rate. The Idaho State Tax Commission collects data and prepares reports on a range of topics. Sr Special Sales Tax Rate.

Depending on local municipalities the total tax rate can be as high as 9. Idaho Sales Tax Table at 6 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax. Average Sales Tax With Local.

The original Idaho state sales tax rate was 3 it has since. S Idaho State Sales Tax Rate 6 c County Sales Tax Rate. This takes into account the rates on the state level county level city level and special level.

Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. The tax data is broken down by zip code and additional locality information location population etc is also included. To review the rules in Idaho visit our state-by-state guide.

L Local Sales Tax Rate. While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected. Average Sales Tax Including Local Taxes.

Idaho has recent rate changes. Automating sales tax compliance can help your. The average cumulative sales tax rate in the state of Idaho is 604.

Click any locality for a full breakdown of. The most populous county in. Fast Easy Tax Solutions.

The Ada County sales tax rate is. When calculating the sales tax for this purchase Steve applies the. Idaho enacted its sales and use tax in 1965 and it was approved by the electorate during the 1966 election.

Ad Find Out Sales Tax Rates For Free. The Idaho State Sales Tax is collected by the merchant on all qualifying sales made within Idaho State. Has impacted many state nexus laws and sales tax collection requirements.

The Idaho state sales tax. The Idaho state sales tax rate is currently. There are a total of 112 local tax jurisdictions across the state collecting an.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Littourati Main Page Blue Highways Moscow Idaho Idaho County Idaho Travel Idaho Adventure

Idaho Vehicle Sales Tax Fees Calculator Find The Best Car Price

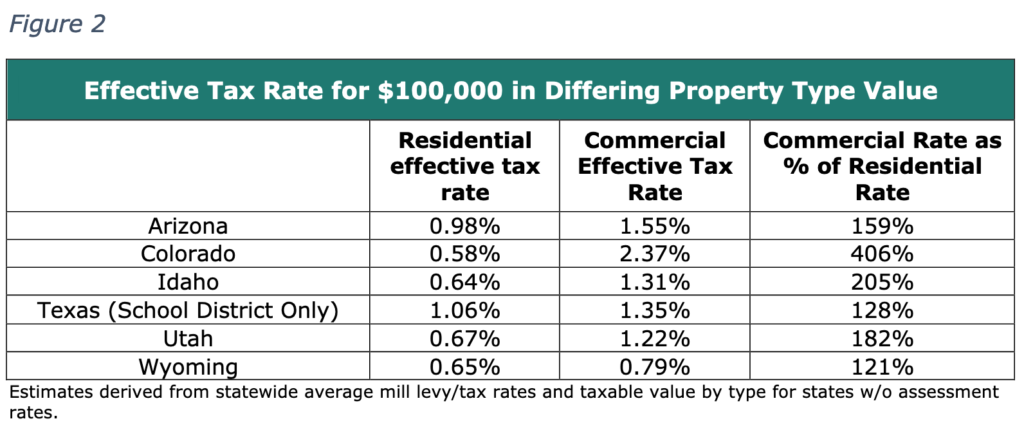

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Idaho Property Taxes Everything You Need To Know

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Sales Taxes In The United States Wikiwand

Idaho State 2022 Taxes Forbes Advisor

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

States With Highest And Lowest Sales Tax Rates

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Idaho Sales Tax Rates By City County 2022

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Utah Sales Tax Small Business Guide Truic